All Categories

Featured

Table of Contents

However, the tax obligation lien and the termination of the lien are considered public info once enrolled on the State Tax Obligation Lien Registry. The Division of Earnings does not regulate the credit bureau company's plan concerning the size of time or the precision of the details they go on a credit report bureau record.

You may send a copy of this notification to the credit score bureau(s) and ask them to to modify or to remove a lien from a credit rating bureau report. Circuit staffs need to utilize the Lien Windows Registry Aid Kind. Directions for reporting are included on the form. For additional questions, comments or worries call 601-923-7391 or email taxliens@dor.ms.gov!.?.!. People and businesses that have actually not paid their taxes might have a certification of lien filed with the recorder of actions and the circuit court in the area where the specific resides or the company is located. The certification of lien filed with the recorder of acts connects to the taxpayer's real and personal residential property.

The Department of Income does not report lien information straight to the credit rating bureau agencies. Nevertheless, the tax lien and the termination of the lien are taken into consideration public details as soon as filed with the recorder of deeds or the circuit court. The Department of Revenue does not control the credit bureau firm's plan regarding the length of time or the accuracy of the details they go on a credit rating bureau record.

How To Tax Lien Investing

Please speak to the circuit clerk or the recorder of acts in the area in which the lien was submitted to obtain main details concerning the lien.

Each year, unsettled tax obligations are offered for purchase at the Tax obligation Lien Sale. Here are some truths to help you comprehend what a tax obligation lien sale financial investment is, and is NOT: When you acquire a tax lien sale certification on building, you end up being a lienholder on the home. Basically, you finance funds to the owner to pay taxes.

Investing In Property Tax Liens

Spending in tax liens via purchase at tax lien sale is simply that a financial investment. Communities can later on seize the legal rights of owners to redeem the residential or commercial property (to get clear title to the residential or commercial property returned to them by paying the tax obligations). While tax obligation title treatment helps cities and towns that require the cash to function, it can be a terrific hardship to those who could be shedding their homes.

, municipalities might sell tax commitments to third-party capitalists at a number of factors in the tax repossession procedure (as receivables, liens or tax obligation titles) to increase prompt profits. The personal financier stands in the municipality's footwear to collect the responsibility and continue the tax obligation foreclosure process.

Gaining time to place with each other a strategy to pay back tax obligations and redeem title to the actual estate can be essential for overdue taxpayers.

60 68. "Understanding the Tax Obligation Repossession Refine" provides a thorough recap of Tax Title Yield and Foreclosure treatments in product that accompanied a 2005 symposium. Legal help for those dealing with foreclosure of the civil liberties of redemption in their residential property may be readily available through Limited Support Depiction. Restricted Assistance Depiction (LAR) is available to any kind of celebration that feels she or he can not afford or does not want a lawyer for the whole case, yet can make use of some help on a minimal basis.

How To Invest In Property Tax Liens

Spending in tax obligation liens and actions with self-directed Individual retirement accounts are appealing investment techniques due to the fact that they are rather easy and affordable to get and handle. And, they have the prospective to make a desirable return on the initial financial investment. When you utilize retired life funds to invest, the liens and/or actions are acquired by the self-directed IRA and are owned by the individual retirement account.

Advanta Individual retirement account oversees lots of financial investments in tax liens and deeds in self-directed Individual retirement accounts. Tax liens are connected to home when owners stop working to pay annual building tax obligation.

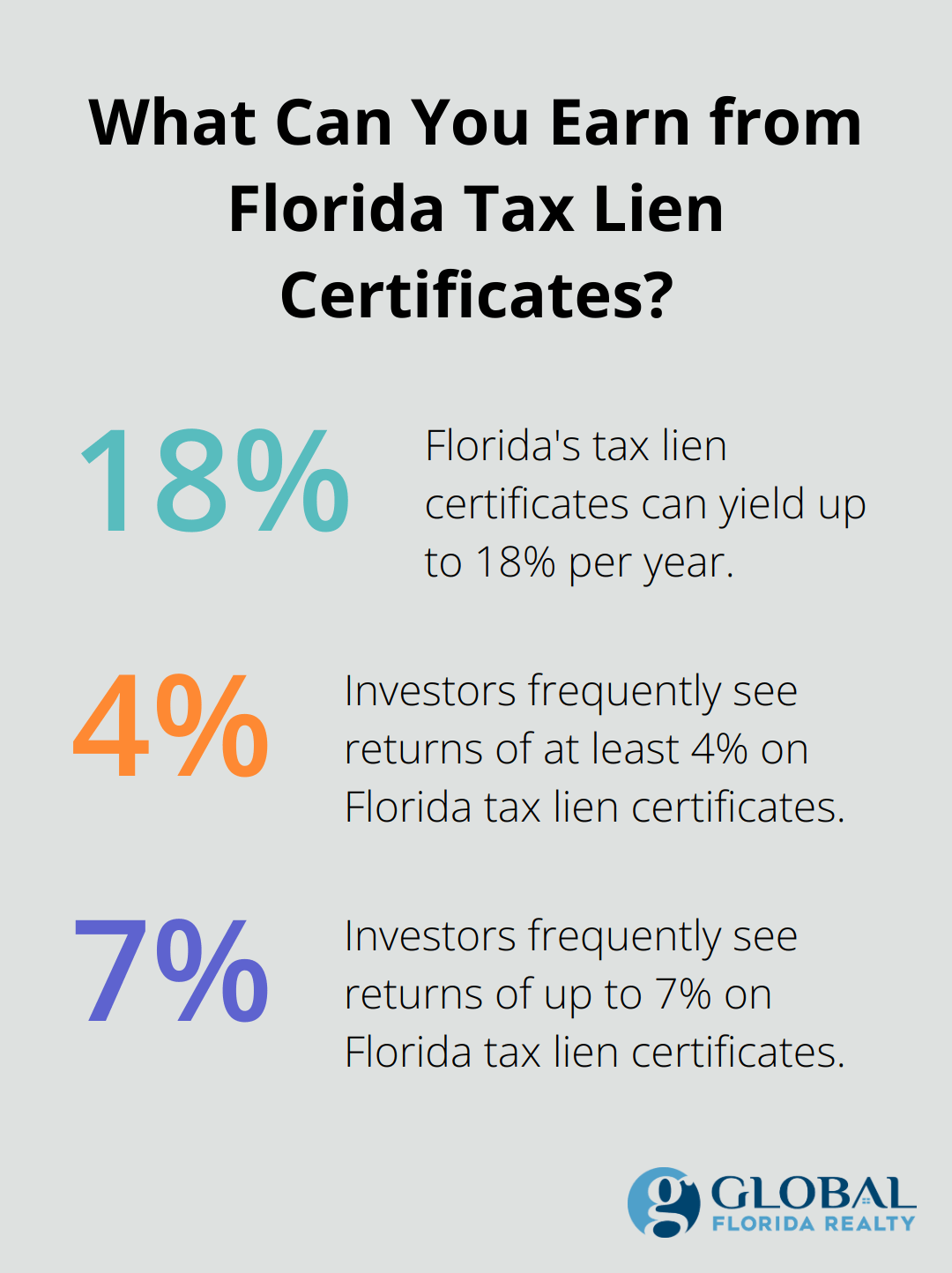

Ruling agencies market these liens at online or online auctions. Investors who win the quote pay the taxes due. The investor appoints and gathers a set passion rate and fees from the residential or commercial property owner. The homeowner has an established timeframe pay the capitalist to get the lien launched from the building.

In situation of default, the financier can take possession of the residential or commercial property and can market it outrightanother method to make earnings. Tax acts work a lot like tax liens when real estate tax remain in arrearswith one important exception: the federal government or town takes instant ownership of home. Tax obligation actions are after that cost public auction, and the capitalist with the highest proposal wins ownership of that building.

Since November 1, 2019, the SCDOR documents state tax liens online in our thorough State Tax obligation Lien Computer System Registry at . The registry consists of all unpaid state tax liens that were formerly filed with county offices. State tax liens are currently released and pleased with the SCDOR, not area workplaces.

How Does Investing In Tax Liens Work

The existing lien equilibrium on the State Tax Lien Computer system registry includes settlements made toward the financial obligation and additional penalty and interest built up. If a taxpayer owes the SCDOR and neglects or falls short to pay a tax obligation financial debt, the SCDOR can provide a state tax lien. A state tax obligation lien is a claim versus your genuine and/or personal residential or commercial property situated in South Carolina.

State tax liens are active for ten years. You can not market or re-finance your property until you repay your tax obligation lien and get a clear title. Tax obligation liens might decrease your debt ranking and effect your capacity to obtain finances or funding. Yes. Tax obligation liens are a public notification of debt.

How To Invest In Tax Liens

, locate the lien you require documentation for making use of the search. As soon as you've located the appropriate lien, click the number in the to watch the or click the day in the to see the notice.

A total checklist of tax obligation liens offered for sale will be available in September in the Routt Area Treasurer's Office or online at Official Tax obligation Lien Public Auction Site. Liens are put versus the residential or commercial properties and are bought by financiers that, in turn, make passion against the tax obligation amounts (Rate of interest is paid on the tax lien, but not on the costs). Usually an effective prospective buyer pays an exceptional rate above the tax obligation liens that are offered in order to acquire a tax lien certification.

Table of Contents

Latest Posts

Tax Deed Foreclosure

What Is Property Tax Sale Auction

Tax Property Foreclosures

More

Latest Posts

Tax Deed Foreclosure

What Is Property Tax Sale Auction

Tax Property Foreclosures